Gold Bull Market Update and Outlook Q4 2025 / Q1 2026

-

Executive Summary

Executive Summary• Base case (60%): The current pullback is a normal retracement within the primary bull trend. We expect consolidation through late Q4-2025 and potentially into January 2026, followed by a resumption of the uptrend in Q1/Q2-2026.

• Drivers remain intact: Persistent central-bank accumulation, reserve-diversification dynamics, and episodic macro/geopolitical risk keep the structural bid under gold.

• Positioning stance: Maintain core long exposure, add tactically on weakness into the $3.8k–$4.0k zone spot equivalent with tight risk controls, and ladder call spreads into Q2-2026.

• Risk skew: Near-term pullback risk persists position shakeouts, macro data surprises. Structural bearish risks are low unless central-bank demand materially softens.

🧭 Market Context & Recent Price Action

• Gold printed successive record highs into mid-October; front-month futures traded above $4,170/oz before easing. Headlines framed the rally as policy and safe-haven led, with year-to-date gains exceptionally strong.

• Central-bank demand continues to underpin the move: WGC and sell-side coverage highlight accelerating official-sector buying and diversification away from FX reserves; banks forecast higher prices into 2026.

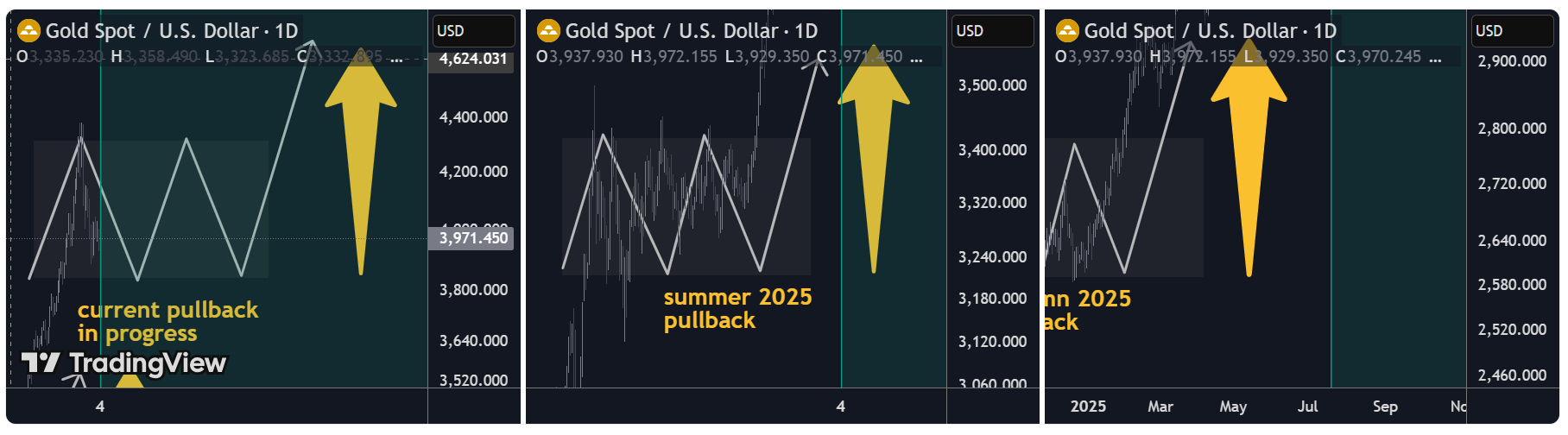

• The current setback aligns with prior bull-market pauses (e.g., Apr–Jul 2025 and Sep 2024–Dec 2024 pullbacks), consistent with the user-stated pattern of multi-month consolidations before trend resumption.

What’s new in headlines late Oct–Nov 2025:

• Pullback is “technical and temporary,” with buy-the-dip framing from UBS; next tactical target cited around $4,200.

• Official-sector flows: Korea & Madagascar exploring reserve increases; PBoC extended buying streak into September.

• WSJ coverage stresses gold’s role in erosion of trust in fiat/central banks and the reserve-diversification theme.

Structural Bull Case 2025-2026

Structural Bull Case 2025-2026- Official-Sector Accumulation:

o Multi-year build in central-bank gold holdings (EM-led) as a sanctions-resilient reserve asset; this remains the single most important marginal buyer narrative. - Reserve Diversification & Financial Geopolitics:

o Evidence that gold’s share of global reserves has risen while some institutions reassess currency composition. - Macro Volatility & Policy Trajectory:

o Periodic growth scares, policy pivots, and real-rate uncertainty sustain hedging demand. Street targets for late-2026 (e.g., ~$4,900 GS) anchor upside convexity. - Market Microstructure:

o Thin above prior highs and crowded shorts on pullbacks can fuel sharp upside re-accelerations when macro catalysts hit data, geopolitics, policy hints.

Technical Map Top-Down

Technical Map Top-Down

• Primary trend: Up. The sequence of higher highs/higher lows since 2024 remains intact; current move is a trend-within-trend consolidation.

• Pullback anatomy: Prior bull pauses (Apr–Jul 2025; Sep–Dec 2024) lasted 2–4 months, with troughs forming on volatility compression and momentum washouts—a template for now.

• Key tactical zones spot-equiv.:

o $3,800–$4,000: First reload area prior breakout shelf / 50–61.8% of the last leg.

o $4,200–$4,250: First resistance / re-acceleration trigger retests of breakdown pivots.

o $4,350–$4,400: High congestion; decisive weekly close above here re-opens ATH extension.

️ Scenario Pathing Q4-2025 → Q2-2026

️ Scenario Pathing Q4-2025 → Q2-2026• Base Case 60% — “Consolidate then resume”:

o Sideways-to-lower into late Q4/Jan 2026 as positioning resets; range $3.8k–$4.2k.

o Breakout resumption in Q1/Q2-2026 as macro and official flows re-assert.

• Bullish Extension 25% — “Shallow dip, quick reclaim”:

o Softer real yields / risk flare trigger swift recapture of $4.2k–$4.4k and new highs earlier in Q1-2026.

o Catalysts: heavier central-bank prints, geopolitical shock, or earlier policy-easing rhetoric.

• Bear-Risk 15% — “Deeper flush, trend intact”:

o Hawkish macro surprise or forced deleveraging drives $3.6k–$3.7k probes; structure holds unless official-sector demand meaningfully fades

🧪 What to Watch High-Signal Indicators

• Official-Sector Data: Monthly updates from WGC, IMF COFER clues, and PBoC reserve disclosures. Continuation of EM purchases = green light for the bull.

• Rates & Liquidity: Real-rate direction and dollar liquidity conditions around data and policy communications.

• Microstructure: CFTC positioning inflections, ETF out/in-flows a lagging but useful confirmation when they finally turn.

• Asia Physical/Policy: China/Japan retail and wholesale dynamics; policy/tax headlines can create short-term volatility.

Strategy & Implementation

Strategy & Implementation- Core:

• Maintain strategic long allocation consistent with mandate e.g., 3–5% risk budget; avoid pro-cyclical reductions during orderly pullbacks. - Tactical Adds

• Scale-in buy program within $3.8k–$4.0k

• Optionality: Buy Q2-2026 call spreads (e.g., 4.2/4.8) on dips; fund via selling Q1-2026 downside put spreads around $3.6k–$3.7k where comfortable with assignment. - Risk Controls

️:

️:

• Hard-stop any tactical adds on weekly close < ~$3.6k or if credible evidence emerges of official-sector demand reversal.

- Official-Sector Accumulation:

-

Q4–Q1 outlook looks strong, but overextension risk is real.

️

️