🟩 Crypto Market Wrap-Up: Bitcoin Tightens, Stablecoins Surge, and Tokenized Stocks Explode | July Recap 📈

-

July is closing out strong for crypto—and if you’re watching on-chain trends and regulatory progress, there’s a lot to be bullish about.

Here’s what’s been moving markets and shaping the next big wave:

Bitcoin Reserves Hit Multi-Year Lows — Supply Shock Incoming?

Bitcoin Reserves Hit Multi-Year Lows — Supply Shock Incoming?Bitcoin exchange reserves dropped another 2% this month, pushing the total down 14% since January. That’s not just a stat—it’s a strong signal.

📉 Less BTC on exchanges = more long-term holders = less available supply = potential price squeeze.In fact, this is the first time since 2018 that less than 15% of BTC’s supply is sitting on centralized exchanges. Analysts are warning: a supply shock might be brewing.

Crypto Chief noted:

“We’ve never seen such a big divergence between OTC/exchange balances and price.” ️ Regulators Step Up — US Congress Passes 3 Crypto Bills

️ Regulators Step Up — US Congress Passes 3 Crypto BillsThe U.S. House passed three major crypto bills in July. The GENIUS Act, now signed into law by President Trump, establishes clear rules for stablecoins—setting the stage for real institutional adoption.

Even though it didn’t allow issuers to pay interest (sorry Coinbase), it added $4B in new stablecoin market cap in just one month. That brings the total market cap to $250B+.

🟢 Monthly active stablecoin addresses also jumped 20%+ to over 38 million.

🪙 Real-World Assets (RWAs) Onchain Pass $25 Billion

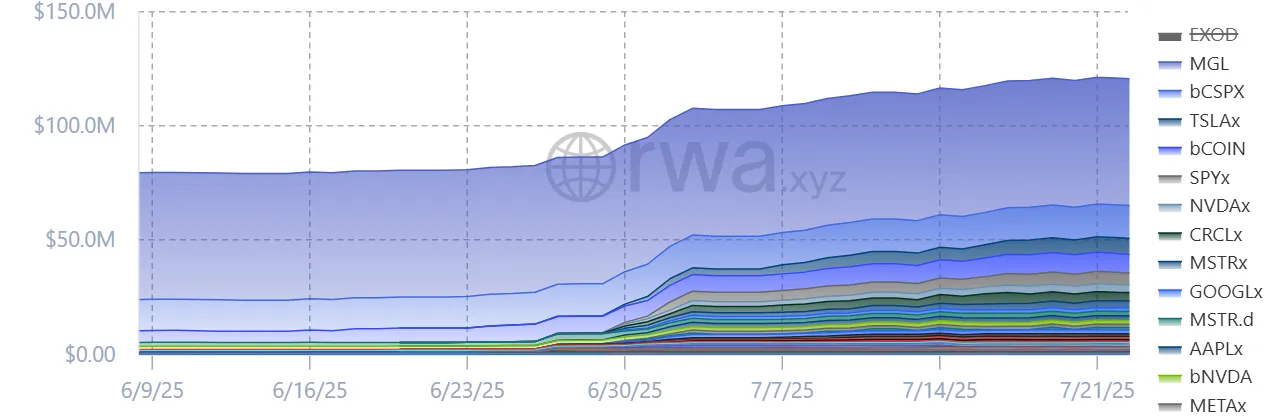

It’s not just stablecoins seeing inflows. RWAs—think tokenized treasuries, private credit, and stocks—continue booming:

Tokenized stocks grew 15% in July, hitting $400M in value Robinhood announced plans to roll out tokenized stock trading RWA wallet activity is up nearly 700% this monthBut it’s not all smooth sailing. Legal questions are growing around tokenized equity that lacks actual ownership rights. Regulators are watching.

️ US States & Global Watchdogs Get to Work

️ US States & Global Watchdogs Get to Work🟨 Three U.S. states passed their own crypto laws in July:

Missouri now regulates crypto ATMs and declares metals-backed digital currencies legal tender. New Hampshire launched a study on stablecoin/RWA regulation. Oregon now treats unclaimed crypto as abandoned after 3 years.🟥 Meanwhile, Arizona vetoed a bill that would’ve let the state hold seized crypto in reserve. (Too bad.)

Global Momentum:

Global Momentum:Bybit, OKX & CoinShares all gained MiCA licenses in Europe. Bitstamp got the green light in Singapore. Ripple and Circle are chasing full U.S. banking licenses. Deutsche Bank’s AllUnity project received approval to issue a euro stablecoin. Why This Matters:

Why This Matters:From record-low BTC supply to booming RWAs and clearer regulation, we’re seeing the building blocks of the next bull wave slot into place.

Stablecoins are growing. Institutions are finally getting the green light. On-chain assets are diversifying. And exchange BTC balances? Just… evaporating.

Whether you're stacking, staking, trading, or building—July set the tone for a high-volatility, high-potential second half of 2025.

Are you positioning yourself for it? Let's talk strategy.

️

️ -

-

This is exactly what a pre-bull setup looks like: supply drying up, regulation clearing paths, and on-chain activity exploding. Feels like we’re heading into an institutional-led wave — not just hype-driven retail. Curious how tokenized stocks will hold up legally though.

-

That $4B surge in stablecoins post-GENIUS Act is no joke. Feels like TradFi is testing the crypto waters quietly — and RWAs are the bridge. Still wondering if regulators will crack down on tokenized assets that don’t include shareholder rights. Risky but massive upside. Thoughts?