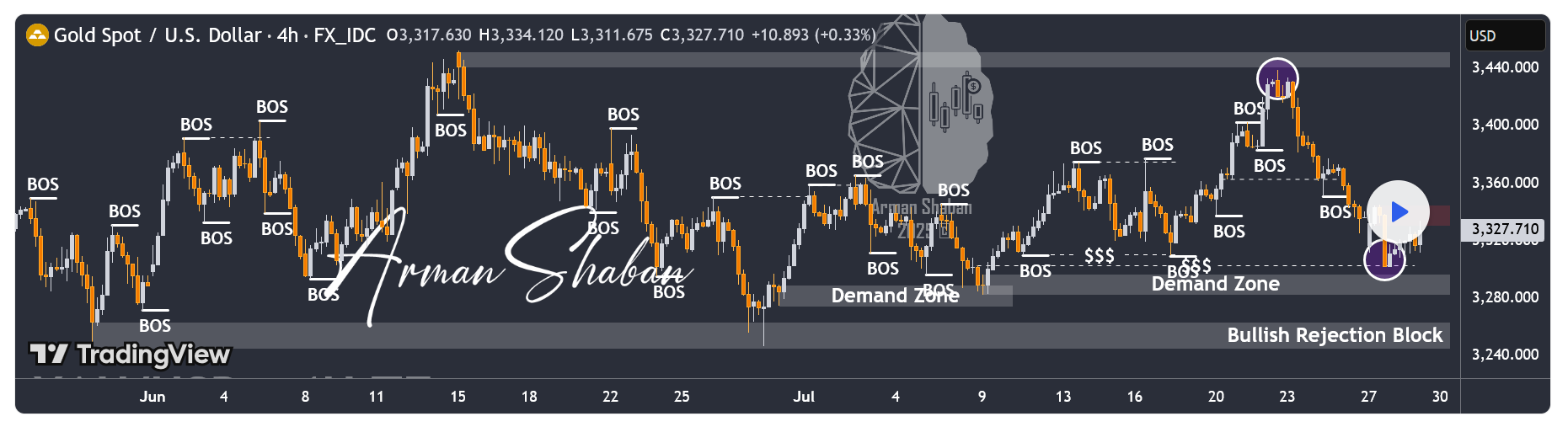

XAU/USD | Gold Below $3345 – Key Demand Awaits at $3282–$3296!

-

By analyzing the gold chart on the 4-hour timeframe, we can see that after dropping to the $3301 area, strong demand came in, helping the price stabilize above $3300 and rally up to over $3334. Currently, gold is trading around $3331. If the price fails to break and hold above $3345 within the next 8 hours, we may see a price correction soon. A key demand zone lies between $3282–$3296, where a strong bullish reaction could occur if price revisits this area. Important supply levels to watch are $3366, $3382, $3393, and $3404.Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

-

Gold just slid under $3,345 on the 4‑hour chart—watch for demand around $3,282–$3,296. The breakout below $3,345 failed to hold, and now price is testing a key confluence zone where horizontal support meets the rising trendline and historical golden-pocket levels (~61.8% retrace). If buyers defend this zone, we could see a reversal back toward $3,330 and possibly $3,350.For traders: consider long entries if price stabilizes above $3,282 with volume confirmation. Otherwise, keep bearish structure intact.

-

The move below $3,345 reflects reduced safe-haven demand amid softening risk sentiment—yet core support at $3,282–$3,296 remains intact. Investor flows have shifted as U.S. macro strength boosts the dollar and Treasury yields, dragging gold lower. Still, technical layers like trendline support and past FVG zones provide a floor.If price drops below $3,282 with conviction, look for a deeper test around $3,250 or $3,230. Bounce above $3,330 though could reset bullish momentum. It’s all about confirmation now.