🐳 Whale Moves: Early Bitcoin Investor Sells 80,000 BTC — Market Barely Flinches, Eyes Higher

-

In a move that turned heads across the crypto market, an early Bitcoin investor just offloaded a jaw-dropping 80,000 BTC through Galaxy Digital — one of the largest notional crypto transactions in history, according to the firm.Let’s break it down — and see why this could be an opportunity, not a panic button.

Real Estate Planning or Market Play?

Real Estate Planning or Market Play?Galaxy didn’t disclose the investor’s name or execution price, but clarified the sale was part of the client’s “real estate planning strategy.”

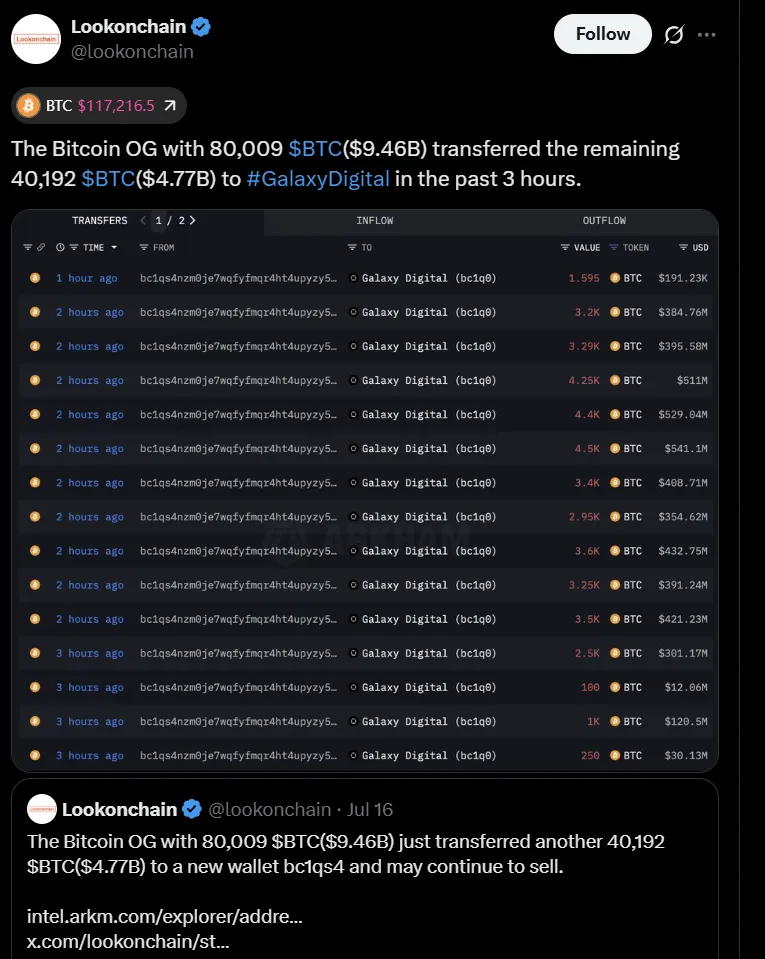

Translation: this wasn’t a panic dump, but a structured, strategic cash-out. Timing? The wallet holding these coins had been dormant for over a decade before suddenly activating this month.According to Lookonchain, the BTC was moved in stages between July 16–17, with 30,000+ BTC making their way to exchanges just before Friday’s brief price dip below $115K.

Bitcoin Price? Barely Blinked

Bitcoin Price? Barely BlinkedAfter the initial drop, Bitcoin bounced back above $117K — and market analysts say the entire 80,000 BTC was “fully absorbed” with no major sell-off cascade.

“Over $9 billion was sold, and Bitcoin barely moved,” said Joe Consorti of Theya. Jason Williams added that this resilience points to massive buying pressure behind the scenes.The last time a single wallet with this much Bitcoin moved was… never. This kind of scale is rare even by whale standards.

🧠 What It Means for YouRather than sparking a bearish reversal, this mega-sale may actually prove bullish:

📈 Bitcoin ETF inflows are still hot 🏢 Corporates are loading BTC into their treasuries 🧾 Regulatory sentiment in the US is easing 🐋 Even massive selloffs are now liquidity events, not market crashesIf you’re a long-term believer, this kind of market maturity is exactly what Bitcoin needs to hit new highs — not just volatility, but strength in the face of it.

Opportunity? You Bet.

Opportunity? You Bet.If whales can offload $9B in BTC and the market shrugs, imagine what it’ll do when demand spikes again.

With ETF flows rising, stablecoin adoption accelerating, and supply tightening post-halving, this may be a rare moment where a sell-off signals strength — not weakness.

Would you have held those 80,000 BTC for over 10 years? Or are you looking to accumulate on the next dip?

Let us know

#Bitcoin #BTC #WhaleAlert #GalaxyDigital #CryptoNews #MarketUpdate #RealEstate #CryptoFinance #BuyTheDip -

One wallet with 80,000 BTC sells, part of estate planning, and Bitcoin barely budges—this says a lot. Some commentators like Scott Melker argue early holders are reducing exposure, but context matters: this was planned, not panic. That said, identity speculation (e.g. MyBitcoin-era wallets possibly linked to Roger Ver or a hacker) adds uncertainty. For traders, it’s a reminder to track large on-chain flows—even quiet sales can trigger volatility if repeated.

-

An 80,000 BTC (~$9 billion) sell-off from a Satoshi-era wallet and the market barely flinched. Galaxy Digital executed the sale via major exchanges and OTC desks, and Bitcoin only dipped briefly below $115K before rebounding back toward $117K. Analysts noted the coins were fully absorbed, signaling strong liquidity and institutional demand. This isn’t panic—it’s proof of maturity.