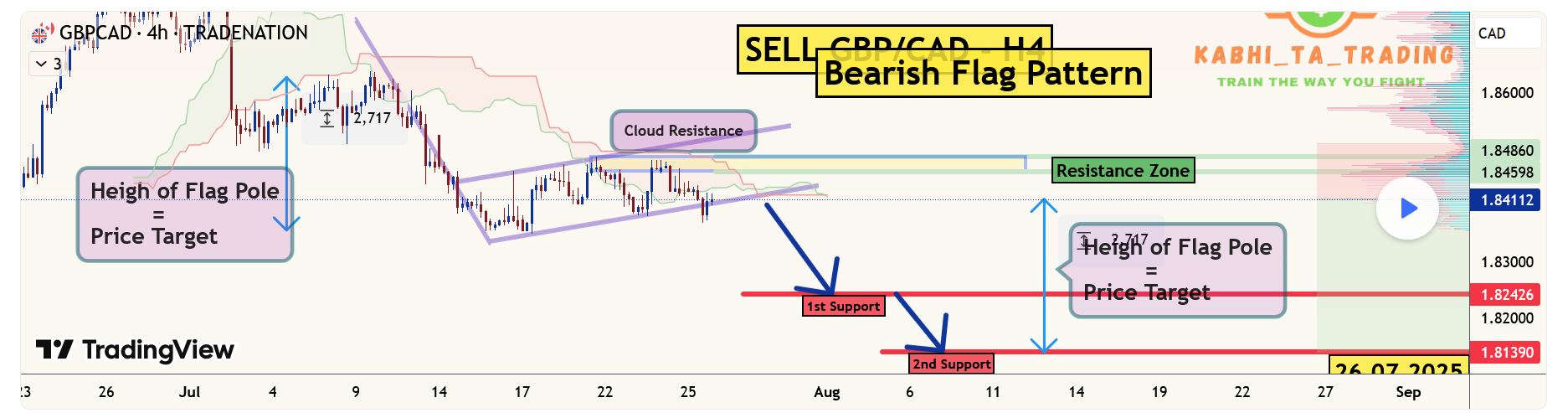

GBP/CAD - H4 - Bearish Flag (26.07.2025)

-

The GBP/CAD Pair on the H4 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Bearish Flag Pattern. This suggests a shift in momentum towards the downside in the coming Days.Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.Target Levels:

1st Support – 1.8242

2nd Support – 1.8139 Please hit the like button and

Please hit the like button and

Leave a comment to support for My Post !

Leave a comment to support for My Post !Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

-

Clear bearish flag on the GBP/CAD 4‑hour chart, classic continuation setup. After a sharp decline, price has consolidated with lower highs and lows inside a rising flag—that’s textbook. The recent rejection near ~1.846–1.850 confirms supply resistance, and a break below the flag support around 1.8416–1.8450 opens a path toward 1.8450 and 1.8320 as next probable targets.

Keep an eye on volume: a convincing 4‑hour close below 1.8416 with increasing volume would validate the move. Stop-loss could sit just above 1.850. Risk/Reward could be favorable around 1:2.5.

Based on ongoing bearish channel structure and flag formation. Targets and levels reference typical TradeView setups. -

Strong technical setup—but context matters. GBP/CAD’s H4 bearish flag forms after a steep decline, with resistance near ~1.846–1.850 and support in the 1.8416–1.8450 zone. A break under support could extend the downtrend to 1.8320 or lower.

That said, momentum indicators like Bollinger Bands and RSI show mild indecision—price recently touched the middle band and reversed, suggesting bearish control but also potential short-term bounce if support holds. Monitoring CAD/GBP fundamentals will also be key—Bond spreads and BoC vs BOE dynamics may trigger volatility that impacts this setup.

That bearish flag on the H4 is looking super clean. Thanks for sharing the key levels—definitely keeping this on my watchlist!

That bearish flag on the H4 is looking super clean. Thanks for sharing the key levels—definitely keeping this on my watchlist!