Liquidity ≠ Volume: The Truth Most Traders Never Learn

-

█ Liquidity ≠ Volume: The Truth Most Traders Never Learn

Most traders obsess over volume bars, but volume is the footprint, not the path forward.If you’ve ever seen price explode with no volume or fail despite strong volume, you’ve witnessed liquidity in action.

█ Here’s what you need to know

Volume Is Reactive — Liquidity Is Predictive

Volume Is Reactive — Liquidity Is Predictive

snapshotVolume tells you what happened. Liquidity tells you what can happen.█ Scenario 1: Price Jumps on Low Volume

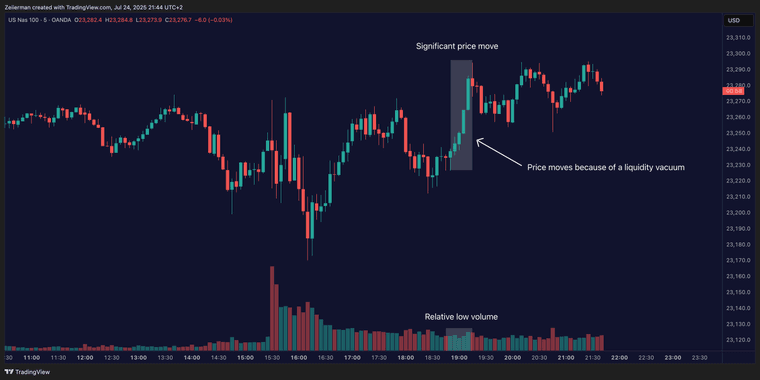

❝ A price can jump on low volume if no liquidity exists above.❞ What’s happening?

What’s happening?The order book is thin above the current price (i.e., few or no sellers). Even a small market buy order clears out available asks and pushes price up multiple levels. Volume is low, but the impact is high because there’s no resistance. Implication:

Implication:

This is called a liquidity vacuum.It can happen before news, during rebalancing, before session openings, on illiquid instruments, or during off-hours. Traders often overestimate the strength of the move because they only see the candle, not the absence of offers behind it.

█ Scenario 2: Move Fails on High Volume

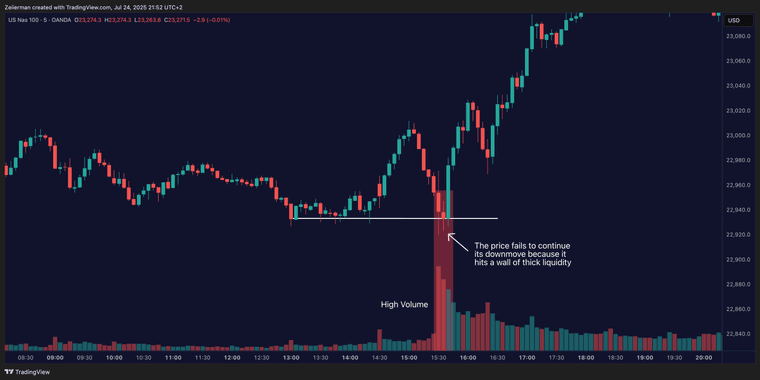

❝ A move can fail on high volume if it runs into a wall of offers or bids.❞ What’s happening?

What’s happening?There’s a strong surge of aggressive buying or selling (high volume). But the order book has deep liquidity at that level — large resting limit orders. The aggressive traders can’t chew through the liquidity wall, and price stalls or reverses. Implication:

Implication:

This is called liquidity absorption.Market makers or institutions may intentionally absorb flow to stop a breakout. Many retail traders mistake this for “fakeouts,” but it’s really liquidity defending a level.

What the Research Says

What the Research SaysCont, Stoikov, Talreja (2014): Price responds more to order book imbalance than trade volume. Bouchaud et al. (2009): Liquidity gaps, not trade size, are what truly move markets. Hasbrouck (1991): Trades only impact price if they consume liquidity. Institutions don’t chase candles — they model depth, imbalance, and liquidity resilience. Where the Alpha Lives

Where the Alpha Lives

Liquidity tells you where the market is weak, strong, or vulnerable — before price moves.Fakeouts happen in thin books. Reversals occur at hidden walls of liquidity. Breakouts sustain when liquidity follows the price, not pulls away.If you understand this, you can:

Enter before volume shows up Avoid chasing dead breakouts Fade failed moves into empty space█ Final Truth

Volume is the echo. Liquidity is the terrain. Alpha is in reading the terrain. You want to study the structure, because price moves toward weakness and away from strength. Learn to see where liquidity is, or where it’s missing, and you’ll see trading with new eyes.

#trading #crypto #coin -

The part about liquidity vacuums hits hard. I’ve been faked out so many times just watching candles without noticing the thin order book above. This post is pure gold for anyone serious about trading.