Tether Freezes \$85K in Stolen Funds — Protector or Permission Police?

-

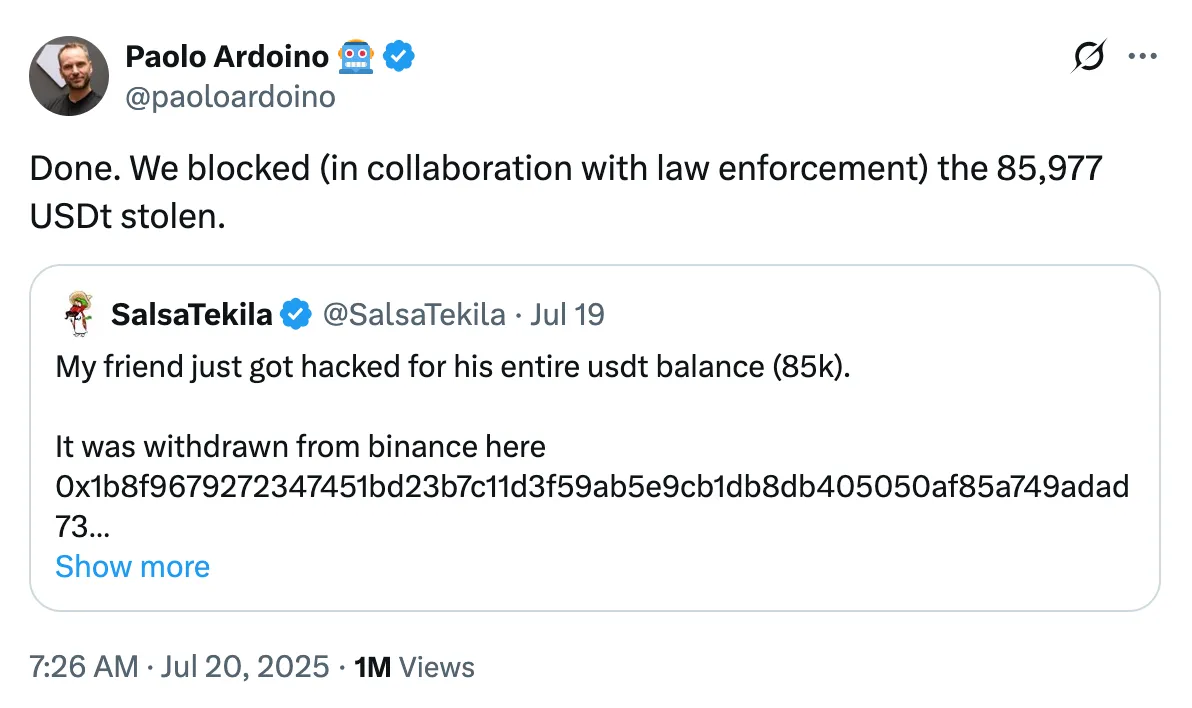

Tether, issuer of the world’s most-used stablecoin, froze $85,877 in USDT this week in cooperation with law enforcement. It’s not their biggest move by far, but it’s sparked fresh debate over stablecoins, censorship, and whether we’re quietly drifting into a crypto-flavored version of the surveillance state.This brings Tether’s freeze tally to $2.5 billion+ and over 2,090 wallets blocked, putting it solidly in “blockchain sheriff” territory

Not Your Keys... Not Your Coins?

Not Your Keys... Not Your Coins?The crypto twist here? Unlike Bitcoin or Ethereum—which can’t be frozen—stablecoins like USDT are centralized. That means Tether can hit pause on your funds at the smart contract level.

In this case, the freeze helped recover stolen money. But this isn’t a one-off:

- Nov 2023: $225M frozen from a romance scam network.

- June 2025: $700M blocked across 112 wallets linked to Iran.

CEO Paolo Ardoino has embraced the enforcer role, saying Tether “takes financial crime seriously” and will continue working with global authorities.

️ Crypto’s Slippery Slope

️ Crypto’s Slippery SlopeNot everyone’s thrilled. Critics warn that if stablecoin issuers keep freezing funds at will, we might as well be using a CBDC with a marketing budget.

One user on X summed it up:

“How is this not just a centralized digital dollar?”

Another said:

“Centralized control has its moments—$85K saved is better than $85K gone.”

The debate boils down to this:

- Pro-freeze: Stops crime, protects users, makes regulators happy.

- Anti-freeze: Compromises decentralization, opens door to censorship.

🧠 TL;DR

- Tether froze $85K tied to stolen funds, adding to a long list of interventions.

- The company’s enforcement power highlights the centralized nature of stablecoins.

- Some applaud the compliance; others say it’s a dangerous precedent.

- Crypto now sits at a crossroads between freedom and control—and stablecoins are leading the charge

In short: Tether’s acting like the adult in the crypto room—but some folks preferred the chaos of the kids’ table.

What do you think—pragmatic progress or the start of stablecoin surveillance?

#crypto #usdt #coin #cryptocurrency

-

Really well written breakdown! The $85K freeze shows both the strength and weakness of stablecoins. It’s good to see stolen funds recovered, but I can’t help thinking this level of control edges too close to centralized finance. The balance between safety and true decentralization feels more fragile than ever.

-

This is such an eye-opener. I appreciate how you explained the ‘blockchain sheriff’ role Tether is taking it really puts things into perspective. I agree that $85K saved is great, but I worry about how easily this power could be misused in the future. The line between protection and surveillance feels very thin.

-