Don't Let Your Crypto Die With You: Why You NEED a Crypto Inheritance Plan

-

Let’s get real:

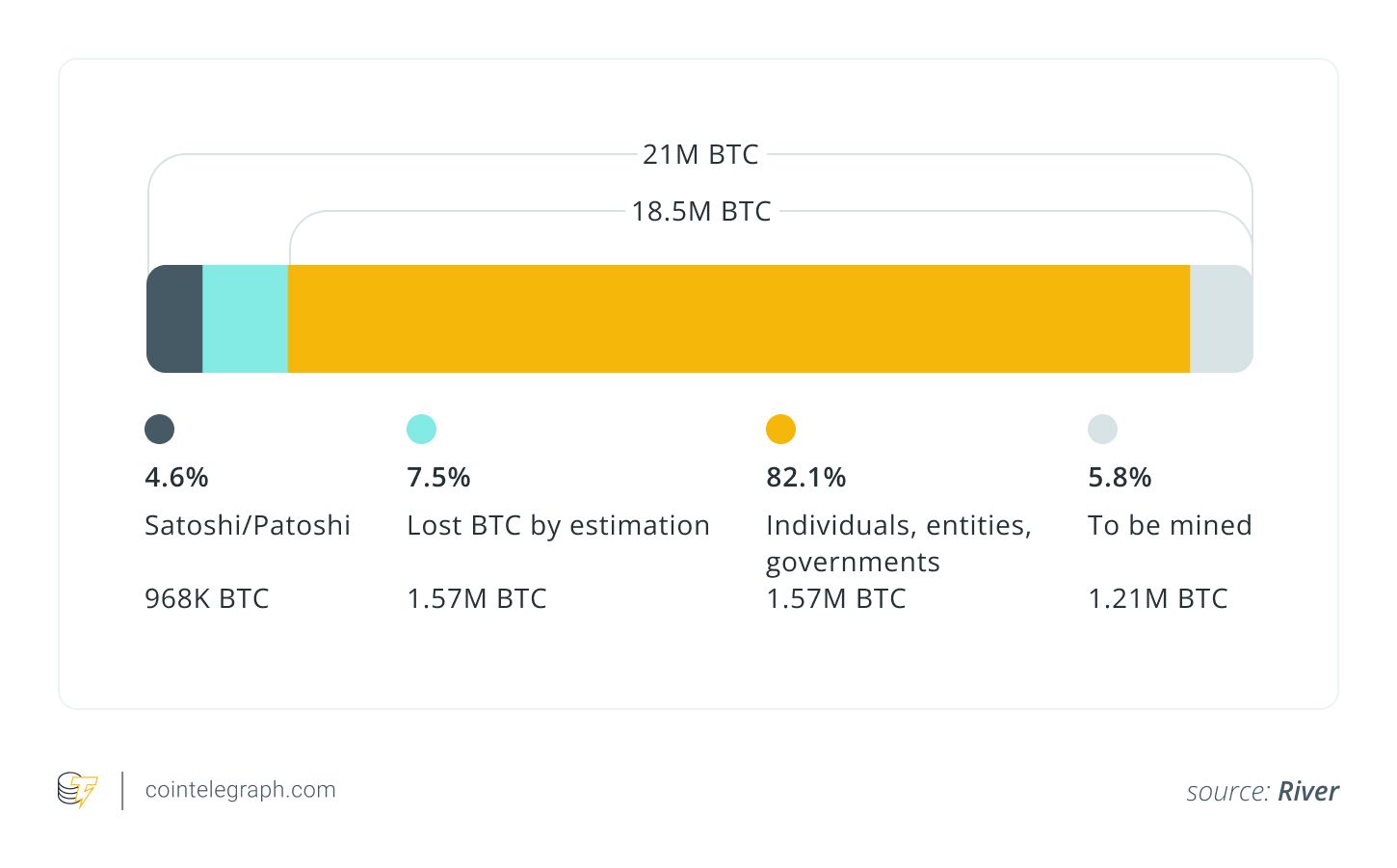

You might be stacking sats, flipping NFTs, farming yield, or just holding for the long haul — but if you don’t have a crypto inheritance plan, all that digital gold could vanish forever when you’re gone. No dramatic hack, no rug pull... just lost forever because no one knew how to access it.Think I’m exaggerating? Over 1.57 million BTC (7.5% of total supply!) is already considered lost. Don’t let your bags be part of that stat.

Here’s how to make sure your crypto legacy actually survives you

Why a Crypto Will Is More Important Than You Think

Why a Crypto Will Is More Important Than You ThinkUnlike bank accounts or brokerage firms, crypto doesn’t come with a "forgot password" option. If your private keys or seed phrases die with you, your assets do too.

A traditional will? Doesn’t cut it. Most don’t even cover digital assets properly.So you need something better:

Clear asset inventory

Clear asset inventory

Secure access instructions

Secure access instructions

A crypto-literate executor

A crypto-literate executor

Legally binding documents

Legally binding documents

🧰 What to Include in Your Inheritance Plan-

Legal Directives:

Work with an estate attorney who understands crypto. Spell out what assets you own, who gets what, and how they should access it. Consider adding a digital asset memorandum to keep sensitive info out of public view. -

Key Management:

Your heirs can't access your crypto without the keys.

Use: Multisig wallets (2-of-3, for example)

Multisig wallets (2-of-3, for example)🧩 Shamir's Secret Sharing to split seed phrases

Encrypted backups or safe deposit boxes

Encrypted backups or safe deposit boxes

Just don’t put your seed phrase in your will. Ever.

-

Smart Contract Automation (Optional):

Platforms like Ethereum allow programmable will execution based on death certificates or time triggers — useful, but always pair with proper legal documents. -

Educate Your Heirs:

Leave clear, step-by-step instructions. You don’t need to show balances now — just make sure your beneficiaries aren’t staring at a Trezor wondering if it’s a fancy USB stick.

️

️ ️ Keep It Private, Keep It Safe

️ Keep It Private, Keep It Safe

Planning’s great — but don’t leak your seed to the world in the process.

Use:📄 Sealed letters or encrypted documents 🔐 Decentralized ID tools to manage permissions 🗃️ Offline storage, not cloud folders named "WALLET INFO 😎"🤯 Common Mistakes to Avoid

❌ Putting seed phrases in the will ❌ Relying only on exchanges (they can freeze, shut down, or get hacked) ❌ Not teaching heirs how crypto works ❌ Assuming this is a one-time setup (spoiler: it's not)🧠 Custodial vs. Non-Custodial: Balance Is Key

Custodial wallets (like on exchanges) are easier for heirs — but riskier long-term.

Non-custodial wallets (like MetaMask, Ledger, etc.) offer more control, but require solid planning to avoid loss.Pro move: Use a combo. Keep the majority in secure, non-custodial wallets, and maybe a small portion in a more accessible platform to ease the transfer process.

️ Review It. Update It. Repeat.

️ Review It. Update It. Repeat.New coins? Update your list. Changed wallets? Update instructions. Life event (marriage, kids, etc.)? Update beneficiaries.Also — tech moves fast. What works today might be obsolete in five years. Set a reminder to review your plan at least annually.

TL;DR – Build Your Crypto Inheritance Plan Like a Pro

TL;DR – Build Your Crypto Inheritance Plan Like a ProList everything: coins, wallets, NFTs, DeFi, the works Lock it down: encrypted storage, multisig, secure backups Document access: instructions your heirs can actually follow Choose a trusted executor who knows crypto Keep your privacy, and update often Don’t die with your wallet locked and no key in sightCrypto is about sovereignty — but with great power comes great responsibility.

Don’t let your legacy vanish into the blockchain abyss. Plan now, or risk your digital fortune being lost forever.Got your crypto will sorted? Any tools or setups you’d recommend? Drop your strategies (not your keys

) below

) below

-