Major Coins and Crypto Stocks Pump — Thank Landmark GENIUS Bill

-

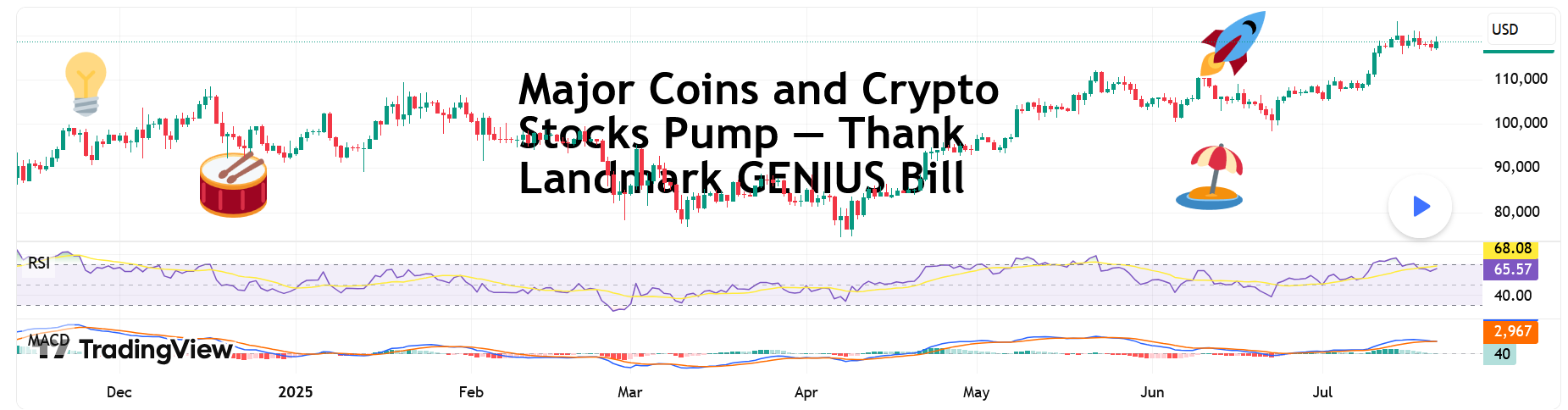

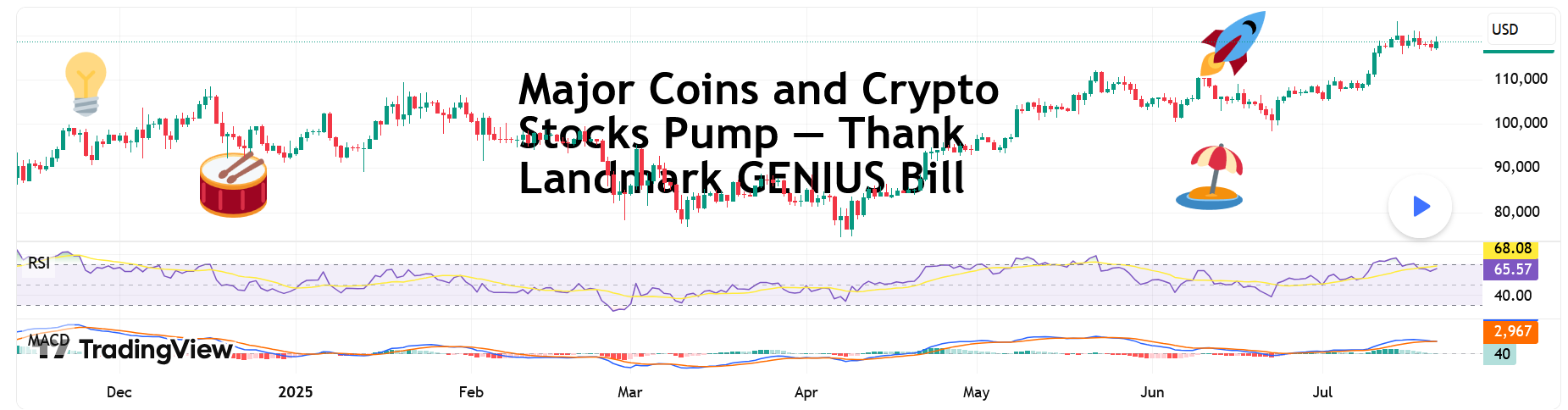

Bitcoin BTCUSD making ATHs? Old news. But Coinbase COIN and Robinhood HOOD hitting those record-high notes? And XRP XRPUSD dangerously close to eclipsing its own peak, while Ethereum keeps chugging along toward $4,000? Now we’re talking.In a market-friendly twist, President Trump signed the GENIUS Act into law on Friday — a sweeping legislative win for crypto. Short for Guiding and Establishing National Innovation for US Stablecoins, the GENIUS Act marks the first major federal framework for digital assets and, more importantly for traders, triggered a firestorm of price action across the space.

Flanked by crypto executives, Republican lawmakers, and a few NFT bros in suits, Trump called the stablecoin-focused bill “perhaps the greatest revolution in financial technology since the birth of the internet.” Bold claim. But judging by what the market’s doing — he might actually be onto something.

The bill, passed 308 to 122 in the House, lays the groundwork for US banks to issue their own stablecoins and create a regulatory moat that finally separates innovation from legal whack-a-mole.

But wait, that’s not all. The House also passed the CLARITY Act and the Anti-CBDC Surveillance State Act. The first one will help determine if cryptos will be considered securities and the second one bans the Federal Reserve from issuing its own coin.

Crypto Market Cap Hits $4 Trillion

Crypto Market Cap Hits $4 TrillionAs the bill cleared Congress and Trump picked up the pen, the entire crypto market cap exploded past $4 trillion for the first time in history with the orange coin holding more than 60% of the market.

It wasn’t just Bitcoin BTCUSD making noise (although it did quietly retest $120,000 boasting a $2.4 trillion valuation, or more than that of Google parent Alphabet GOOGL).

The real momentum was coming from the stocks and altcoins — especially those with exposure to the suddenly green-lit US regulatory scene.

Coinbase: To the Moon and Beyond

Coinbase: To the Moon and BeyondLet’s talk about Coinbase, ticker symbol COIN, and now also, apparently, ticker symbol

.

.Shares surged over 8% on Friday to hit a new record session high of $445, giving the US-based exchange a market cap of over $100 billion. Not bad for a company that spent most of 2022 playing dodgeball with the SEC.

The GENIUS Act (and its siblings) cleared a path for institutional crypto adoption — and no one stands to gain more than Coinbase. It’s the go-to exchange for institutional custody and compliance. And now, with banks dipping their toes into stablecoin waters, guess who gets to facilitate those flows? Exactly.

Coinbase has now rallied over 63% year-to-date, putting it back into market darling territory — and giving early bulls a solid reason to post their PnLs again.

Robinhood: Meme Stock No More?

Robinhood: Meme Stock No More?Wait, what’s that clamor? It’s the “HOOD to $100” crowd dusting off their 2021 hats.

Robinhood HOOD also saw a serious lift from the legislative push — hitting an all-time session high of $113 on Friday. The shares are up 180% in 2025 alone.

While most remember Robinhood for its meme stock legacy, the app has quietly built a towering crypto trading platform in the US. And now, with Congress cracking open the stablecoin lane and clearing legal fog, it’s suddenly a real contender in the digital asset arms race.

Add to that Trump’s pledge to dismantle crypto-hostile policies from the previous administration (many of which affected Robinhood’s crypto operations), and it’s no wonder the stock is flying.

Stablecoins: Boring Coins Are Now Big Biz

Stablecoins: Boring Coins Are Now Big BizYou’d be forgiven for snoozing through most stablecoin headlines. After all, they don’t moonshot or do anything but sit idle.

But make no mistake — this is where the real money’s watching. JPMorgan CEO Jamie Dimon, not known for casual crypto endorsements, said last week his bank will now be “involved in both JPMorgan deposit coin and stablecoins.”

That’s a seismic shift. For years, traditional banks sat on the sidelines while Circle USDC and Tether USDT built billion-dollar stablecoin empires. Now, thanks to the GENIUS Act, the door is open for regulated banks to issue digital dollars backed by FDIC-level trust — and potentially eat into the DeFi-native players’ lunch.

Boring’s about to get very profitable.

XRP: Return of the Ripple?

XRP: Return of the Ripple?You know it’s a bull market when XRP XRPUSD shows up uninvited and still gets the VIP booth.

The one-time courtroom drama token surged over 60% in the past two weeks, hitting $3.50 and inching dangerously close to its all-time high. Ripple’s comeback arc may finally be getting its payoff.

With legal pressure fading and Congress setting new guardrails for digital assets, XRP’s regulatory risks just got a lot less scary. Plus, institutions looking for faster cross-border rails may find XRP’s network a bit more attractive when Washington’s no longer breathing down its neck.

Ethereum: Quietly Eyeing $4,000

Ethereum: Quietly Eyeing $4,000Ethereum ETHUSD might not be making headlines like Bitcoin or XRP, but don't let the quiet confidence fool you.

ETH has been rising steadily, gaining almost 50% in the last two weeks, and Monday morning was trading just shy of $3,800. With regulatory uncertainty waning, and the market treating Ether more like an investment than a utility token, it’s slowly reclaiming its 2025 highs.

Factor in the growing number of ETH-based ETFs, tokenized real-world assets (hello, Treasury bills onchain), and the boom in stablecoins running on Ethereum rails… and you’ve got a slow-burn bull case building brick by brick.

Washington, WAGMI?

Washington, WAGMI?So, what’s the takeaway?

For the first time, Congress passed crypto legislation that didn’t come with a hidden poison pill. The GENIUS Act, along with the CLARITY Act, have made more legislative progress in a week than years of courtroom wrangling and ETF lobbying combined.

Trump, with his pro-crypto stance and deep industry ties (after all, he did launch his own coin not too long ago), just turned crypto into a political weapon — and a market darling. Is 2025 shaping up to be the year Washington went full Web3?

Let’s hear it from you: Drop your thoughts in the comments and let’s spin up the discussion.

#crypto #coin #cryptocurrency #BTC #USDT -

Bitcoin BTCUSD making ATHs? Old news. But Coinbase COIN and Robinhood HOOD hitting those record-high notes? And XRP XRPUSD dangerously close to eclipsing its own peak, while Ethereum keeps chugging along toward $4,000? Now we’re talking.In a market-friendly twist, President Trump signed the GENIUS Act into law on Friday — a sweeping legislative win for crypto. Short for Guiding and Establishing National Innovation for US Stablecoins, the GENIUS Act marks the first major federal framework for digital assets and, more importantly for traders, triggered a firestorm of price action across the space.

Flanked by crypto executives, Republican lawmakers, and a few NFT bros in suits, Trump called the stablecoin-focused bill “perhaps the greatest revolution in financial technology since the birth of the internet.” Bold claim. But judging by what the market’s doing — he might actually be onto something.

The bill, passed 308 to 122 in the House, lays the groundwork for US banks to issue their own stablecoins and create a regulatory moat that finally separates innovation from legal whack-a-mole.

But wait, that’s not all. The House also passed the CLARITY Act and the Anti-CBDC Surveillance State Act. The first one will help determine if cryptos will be considered securities and the second one bans the Federal Reserve from issuing its own coin.

Crypto Market Cap Hits $4 Trillion

Crypto Market Cap Hits $4 TrillionAs the bill cleared Congress and Trump picked up the pen, the entire crypto market cap exploded past $4 trillion for the first time in history with the orange coin holding more than 60% of the market.

It wasn’t just Bitcoin BTCUSD making noise (although it did quietly retest $120,000 boasting a $2.4 trillion valuation, or more than that of Google parent Alphabet GOOGL).

The real momentum was coming from the stocks and altcoins — especially those with exposure to the suddenly green-lit US regulatory scene.

Coinbase: To the Moon and Beyond

Coinbase: To the Moon and BeyondLet’s talk about Coinbase, ticker symbol COIN, and now also, apparently, ticker symbol

.

.Shares surged over 8% on Friday to hit a new record session high of $445, giving the US-based exchange a market cap of over $100 billion. Not bad for a company that spent most of 2022 playing dodgeball with the SEC.

The GENIUS Act (and its siblings) cleared a path for institutional crypto adoption — and no one stands to gain more than Coinbase. It’s the go-to exchange for institutional custody and compliance. And now, with banks dipping their toes into stablecoin waters, guess who gets to facilitate those flows? Exactly.

Coinbase has now rallied over 63% year-to-date, putting it back into market darling territory — and giving early bulls a solid reason to post their PnLs again.

Robinhood: Meme Stock No More?

Robinhood: Meme Stock No More?Wait, what’s that clamor? It’s the “HOOD to $100” crowd dusting off their 2021 hats.

Robinhood HOOD also saw a serious lift from the legislative push — hitting an all-time session high of $113 on Friday. The shares are up 180% in 2025 alone.

While most remember Robinhood for its meme stock legacy, the app has quietly built a towering crypto trading platform in the US. And now, with Congress cracking open the stablecoin lane and clearing legal fog, it’s suddenly a real contender in the digital asset arms race.

Add to that Trump’s pledge to dismantle crypto-hostile policies from the previous administration (many of which affected Robinhood’s crypto operations), and it’s no wonder the stock is flying.

Stablecoins: Boring Coins Are Now Big Biz

Stablecoins: Boring Coins Are Now Big BizYou’d be forgiven for snoozing through most stablecoin headlines. After all, they don’t moonshot or do anything but sit idle.

But make no mistake — this is where the real money’s watching. JPMorgan CEO Jamie Dimon, not known for casual crypto endorsements, said last week his bank will now be “involved in both JPMorgan deposit coin and stablecoins.”

That’s a seismic shift. For years, traditional banks sat on the sidelines while Circle USDC and Tether USDT built billion-dollar stablecoin empires. Now, thanks to the GENIUS Act, the door is open for regulated banks to issue digital dollars backed by FDIC-level trust — and potentially eat into the DeFi-native players’ lunch.

Boring’s about to get very profitable.

XRP: Return of the Ripple?

XRP: Return of the Ripple?You know it’s a bull market when XRP XRPUSD shows up uninvited and still gets the VIP booth.

The one-time courtroom drama token surged over 60% in the past two weeks, hitting $3.50 and inching dangerously close to its all-time high. Ripple’s comeback arc may finally be getting its payoff.

With legal pressure fading and Congress setting new guardrails for digital assets, XRP’s regulatory risks just got a lot less scary. Plus, institutions looking for faster cross-border rails may find XRP’s network a bit more attractive when Washington’s no longer breathing down its neck.

Ethereum: Quietly Eyeing $4,000

Ethereum: Quietly Eyeing $4,000Ethereum ETHUSD might not be making headlines like Bitcoin or XRP, but don't let the quiet confidence fool you.

ETH has been rising steadily, gaining almost 50% in the last two weeks, and Monday morning was trading just shy of $3,800. With regulatory uncertainty waning, and the market treating Ether more like an investment than a utility token, it’s slowly reclaiming its 2025 highs.

Factor in the growing number of ETH-based ETFs, tokenized real-world assets (hello, Treasury bills onchain), and the boom in stablecoins running on Ethereum rails… and you’ve got a slow-burn bull case building brick by brick.

Washington, WAGMI?

Washington, WAGMI?So, what’s the takeaway?

For the first time, Congress passed crypto legislation that didn’t come with a hidden poison pill. The GENIUS Act, along with the CLARITY Act, have made more legislative progress in a week than years of courtroom wrangling and ETF lobbying combined.

Trump, with his pro-crypto stance and deep industry ties (after all, he did launch his own coin not too long ago), just turned crypto into a political weapon — and a market darling. Is 2025 shaping up to be the year Washington went full Web3?

Let’s hear it from you: Drop your thoughts in the comments and let’s spin up the discussion.

#crypto #coin #cryptocurrency #BTC #USDT@Lexluther

"Wow, this breakdown is spot on! The GENIUS Act really feels like a turning point for the entire crypto market. Seeing both COIN and HOOD reach ATHs alongside Bitcoin’s dominance is just wild 2025 is definitely a different game. Thanks for sharing this detailed analysis, Lexluther. It’s the kind of clarity we need right now -

This post honestly gave me chills. The way you connected the GENIUS Act to the explosive growth of Coinbase, Robinhood, and even stablecoins is super insightful. I hadn’t even considered how much of a boost regulated bank issued stablecoins could bring. Definitely feels like we’re entering a whole new era of crypto adoption.

-

Love how you broke this down not just the hype around Bitcoin, but also the quiet but powerful moves from Ethereum and XRP. It’s refreshing to see a post that connects legislation to real market dynamics without being overly technical. Big respect for sharing this!

-

Legacy.app’s Strategic Positioning in the New Regulatory Landscape:-

Legacy.app’s rise as a crypto trading contender aligns perfectly with the tectonic shifts in U.S. crypto policy. The platform’s focus on automated trading, real-time analytics, and cross-platform accessibility positions it to capitalize on the regulatory clarity brought by the "GENIUS Act" (now law) and the advancing ' CLARITY Act -

-

The GENIUS Act might be the biggest policy shift for crypto since the 2017 ICO boom. But the real alpha? Banks issuing their own stablecoins means serious capital is about to flood in — and Coinbase is positioned like BlackRock was pre-ETF era. Buckle up.

-

Critical Questions:

- Will compliance costs negate the benefits for smaller projects?

- How will the SEC's new rulemaking powers impact DeFi?

- Are we seeing a 'buy the rumor, sell the news' setup?

Trade Accordingly:

✓ Take partial profits on crypto stocks (already pricing perfection)

✓ Accumulate quality altcoins not yet reacting

✓ Monitor Treasury guidance drafts in coming weeks