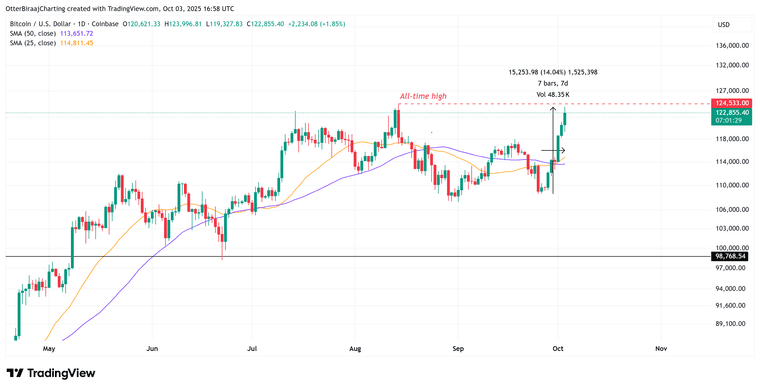

BTC Eyes $124K With US Investors Leading Demand

-

Bitcoin has staged a powerful 14% rally over the past week, climbing from lows near $108,600 to almost $124,000 — just shy of its all-time high. Analysts attribute the move to US-led demand, onchain data showing a $1.6 billion taker buy volume spike, and a Coinbase Premium Gap of $92, signaling Americans are paying more per BTC.

The rally coincides with the US government shutdown, which has delayed economic data and stoked uncertainty — historically a fertile backdrop for crypto speculation.

-

Bitcoin surged 14% this week, rebounding from $108,600 to nearly $124,000 — just below its record high.

Analysts credit the move to aggressive U.S. buying, highlighted by a $1.6 billion taker buy spike and a $92 Coinbase Premium Gap, showing Americans paying a premium per BTC.

The rally also aligns with renewed institutional flows and strengthening ETF inflows, reinforcing bullish sentiment across the market. -

BTC’s 14% weekly rally — from $108,600 to just under $124,000 — reflects robust U.S. demand.

A $1.6 billion surge in taker buy volume and a $92 Coinbase Premium Gap confirm institutions and retail buyers are driving momentum.

With ETF inflows rising and onchain activity heating up, traders say Bitcoin could soon test new all-time highs.