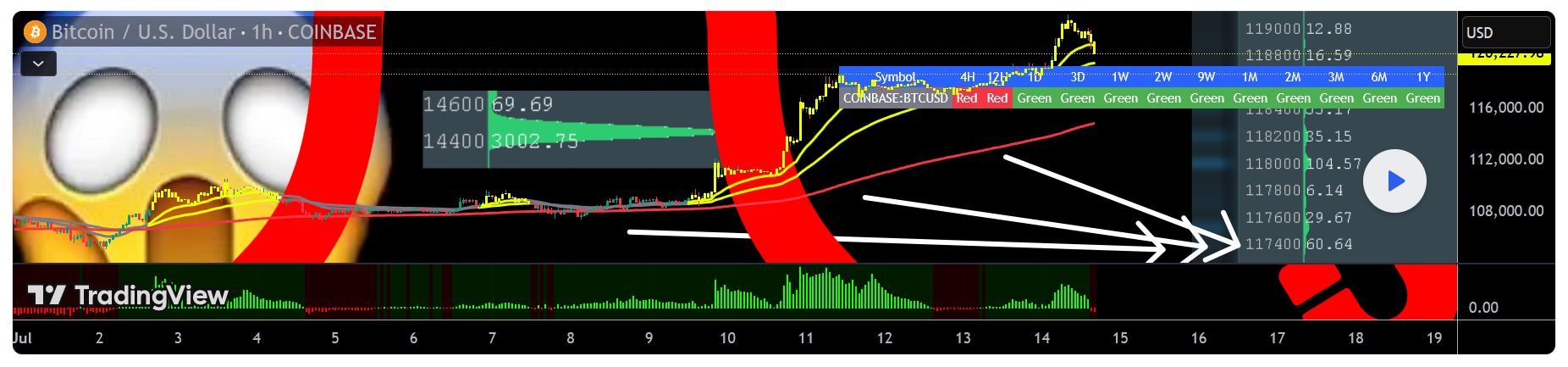

BITCOIN- MONSTER ORDERS IN THE BOOK -> You Know What This Means

-

“Monster orders” are exceptionally large buy-limit orders clustered roughly 7 % beneath the current market price.

Large buy-limit walls can act like a price magnet—deep liquidity attracts algos and traders hunting fills, often pulling price straight toward the level.

Once the wall absorbs the selling pressure, the magnet flips: liquidity dries up, supply thins, and price can rip away from that zone with force.They create a visible demand wall in the order book, signalling that whales / institutions are ready to absorb a dip and accumulate at that level. Price will often wick into this zone to fill the wall, then rebound sharply—treat the 7 % band as potential support or entry. Such walls can act as liquidity traps: market makers may push price down to trigger retail stop-losses before snapping it back up. Confirm that the wall persists as price approaches and that spot + derivatives volume rises; if the wall disappears, it may have been spoofing. Always combine order-book context with trend, momentum and higher-time-frame support for higher-probability trades, Just like the extremely powerful indicators on the chart.#BTC #USDT #crypto #coin #cryptocurrency

-

Wow, the concept of “monster orders” acting like price magnets is fascinating. It really shows how liquidity can shift the entire dynamic of a market—first drawing in sellers, then suddenly flipping into an explosive move. Love the clarity in this breakdown!

-

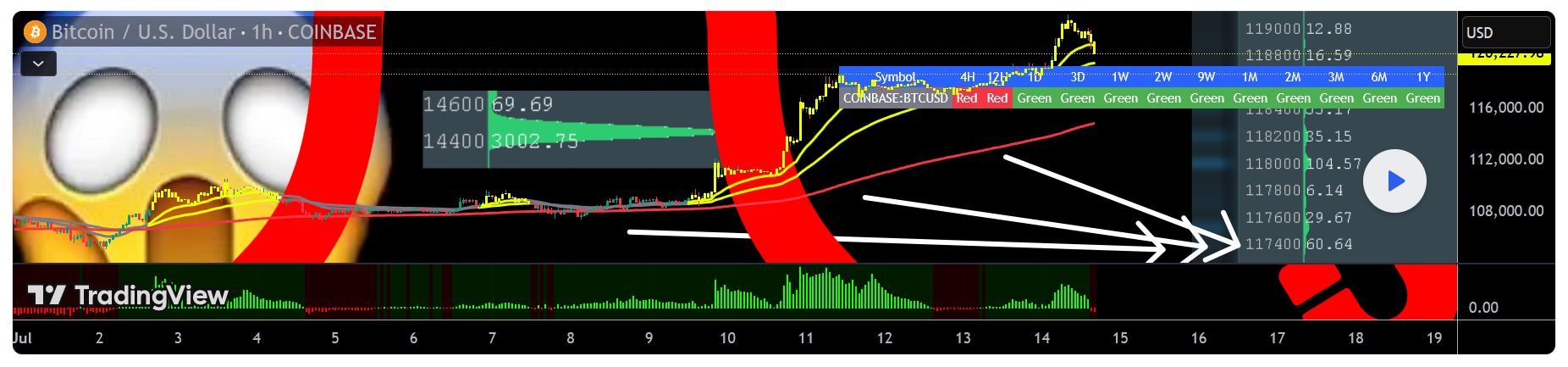

“Monster orders” are exceptionally large buy-limit orders clustered roughly 7 % beneath the current market price.

Large buy-limit walls can act like a price magnet—deep liquidity attracts algos and traders hunting fills, often pulling price straight toward the level.

Once the wall absorbs the selling pressure, the magnet flips: liquidity dries up, supply thins, and price can rip away from that zone with force.They create a visible demand wall in the order book, signalling that whales / institutions are ready to absorb a dip and accumulate at that level. Price will often wick into this zone to fill the wall, then rebound sharply—treat the 7 % band as potential support or entry. Such walls can act as liquidity traps: market makers may push price down to trigger retail stop-losses before snapping it back up. Confirm that the wall persists as price approaches and that spot + derivatives volume rises; if the wall disappears, it may have been spoofing. Always combine order-book context with trend, momentum and higher-time-frame support for higher-probability trades, Just like the extremely powerful indicators on the chart.#BTC #USDT #crypto #coin #cryptocurrency

I appreciate how this explains both the psychology and mechanics behind large buy walls. It’s not just about size—it’s how they attract and react that really matters. Super useful for understanding price action better!

-

Wow, this is such an underrated concept. Most traders focus only on candles or indicators, but these deep monster buy walls tell you where the real players are waiting. That 7% zone becomes more than support — it’s a battlefield. When price wicks into that demand, it’s not random, it’s opportunity. Combine that with volume confirmation and trend context, and it’s often the smartest place to look for a high-probability reversal.